Credit Counselling Singapore: Expert Services with EDUdebt

Credit Counselling Singapore: Expert Services with EDUdebt

Blog Article

Exactly How Credit Score Therapy Can Transform Your Financial Future: Strategies for Getting Security

Credit report counselling presents a structured strategy to economic management, supplying individuals the devices required for sustainable financial stability. The trip to monetary security includes even more than just first methods; it requires recurring commitment and understanding of the more comprehensive effects of monetary decisions.

Understanding Debt Therapy

Counselling sessions commonly cover important subjects such as understanding credit score reports, acknowledging the effects of various financial debt types, and determining reliable payment strategies. By cultivating an educated viewpoint, credit scores therapy assists individuals make sound financial decisions.

The objective of credit scores therapy is to gear up individuals with the tools necessary to navigate their financial scenarios efficiently. As an aggressive measure, it encourages clients to adopt healthier financial habits and impart a sense of responsibility. Eventually, credit score coaching offers not only as a way of resolving prompt economic problems yet additionally as a structure for long-lasting monetary wellness.

Benefits of Credit Report Therapy

Involving in credit report coaching uses many advantages that extend beyond immediate debt relief. Among the key advantages is the advancement of an individualized monetary plan customized to a person's special scenarios. This plan often consists of budgeting methods and techniques to take care of costs better, cultivating economic proficiency and discipline.

Moreover, credit report counselling gives access to experienced experts who can supply skilled advice, aiding people understand their credit history reports and ratings. This knowledge equips customers to make informed choices concerning their financial resources and advertises accountable credit rating use in the future.

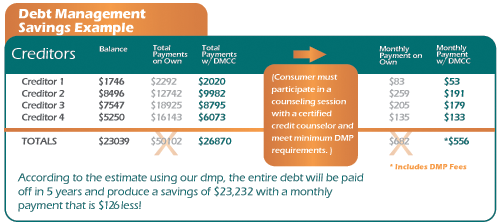

Another considerable advantage is the potential for reduced rates of interest or negotiated settlements with creditors. Credit score counsellors often have established connections with loan providers, which can bring about extra favorable terms for clients, relieving the concern of payment.

Furthermore, debt coaching can play an essential function in emotional wellness. By attending to economic concerns proactively, people can ease stress and anxiety and anxiousness related to frustrating financial debt, bring about a boosted total top quality of life.

Inevitably, debt coaching not just help in attaining short-term financial relief yet additionally furnishes individuals with the tools and expertise essential for lasting monetary stability and success.

Trick Approaches for Success

Attaining monetary stability calls for a critical technique that includes various key elements. Initially, it is vital to produce a comprehensive spending plan that properly shows income, expenditures, and cost savings goals. This spending plan serves as a roadmap for taking care of financial resources and enables individuals to recognize areas for improvement.

Secondly, focusing on debt settlement is critical. Methods such as the snowball or avalanche methods can efficiently reduce financial debt problems. The snowball method concentrates on settling smaller financial debts first, while the avalanche approach targets higher-interest financial obligations to reduce overall passion expenses.

In addition, constructing an emergency fund is essential for monetary safety and security. Establishing aside 3 to six months' worth of living costs can offer a barrier against unpredicted scenarios, decreasing dependence on debt.

Additionally, continuous monetary education and learning plays a significant function in effective credit history coaching. Staying notified regarding economic products, rate of interest, and market patterns encourages individuals to make much better economic decisions.

Choosing the Right Counsellor

Selecting a competent credit rating counsellor is an essential action in the journey toward monetary stability. Begin by investigating counsellors associated with credible organizations, such as the National Foundation for Credit Scores Therapy (NFCC) or the Financial Counseling Organization of America (FCAA)

Next, analyze the counsellor's qualifications and experience. Search for licensed professionals with a strong record in credit history counselling, financial obligation monitoring, and monetary education and learning. It is necessary that the counsellor demonstrates a comprehensive understanding of your details requirements and challenges.

In addition, consider their method to coaching. A great credit history counsellor should prioritize your monetary view publisher site goals and use personalized approaches instead of one-size-fits-all remedies. Routine an initial consultation to assess how comfortable you really feel discussing your monetary scenario and whether the counsellor's communication design aligns with your expectations.

Lastly, ask about solutions and fees provided. Openness in costs and a clear understanding of what to anticipate from the coaching procedure are vital in developing a trusting relationship.

Keeping Financial Security

Maintaining monetary security calls for ongoing commitment and aggressive management of your funds. This includes regularly evaluating your revenue, expenses, and financial savings to guarantee that your financial practices straighten with your long-lasting objectives. Establishing a thorough budget plan is a fundamental step; it supplies a clear photo of your economic health and wellness and enables you to identify locations where modifications may be essential.

In addition, producing a reserve can act as a monetary barrier versus unforeseen expenditures, thereby protecting against reliance on credit. Objective to conserve a minimum of 3 to six months' worth of living expenditures to improve your economic safety and security. Routinely examining and readjusting your spending visit site practices will certainly also promote technique and liability.

Furthermore, monitoring your credit scores report and attending to any kind of inconsistencies can substantially affect your monetary stability. A healthy and balanced credit report not only opens up doors for better funding terms however likewise shows accountable monetary behavior.

Final Thought

In summary, credit therapy offers as a crucial resource for people looking for to enhance their monetary security. Inevitably, the transformative potential of credit score coaching lies in its ability to furnish people with the devices necessary for long-lasting economic success.

The trip to financial stability includes even more than just preliminary approaches; it requires continuous his response dedication and understanding of the broader implications of monetary choices.The objective of credit score coaching is to equip individuals with the tools needed to navigate their monetary scenarios efficiently. Ultimately, credit counselling serves not just as a means of attending to prompt monetary problems however also as a foundation for lasting economic health.

Keeping economic security calls for continuous commitment and positive administration of your monetary resources.In summary, credit score therapy offers as an essential source for people seeking to improve their monetary stability.

Report this page